Cryptocurrency insurance serves as a critical tool in managing the risks associated with digital assets within a complex legal and regulatory framework. This article delves into the legal landscape surrounding cryptocurrency insurance, providing valuable insights into key considerations for insurers, investors, and regulators navigating this evolving sector.

1. Regulatory Frameworks and Compliance Requirements

The regulatory environment for cryptocurrency insurance varies significantly across jurisdictions, presenting insurers with a complex landscape of laws and regulations. In the United States, insurers offering coverage for cryptocurrencies must adhere to state-specific insurance regulations, as well as federal laws such as the Securities Act of 1933 and the Securities Exchange Act of 1934.

Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is particularly crucial to prevent financial crimes and ensure the legitimacy of insured transactions involving digital assets. These regulatory requirements aim to protect consumers and maintain the integrity of financial markets, imposing strict standards on insurers to uphold transparency and accountability in their operations.

2. Legal Challenges in Crypto Insurance

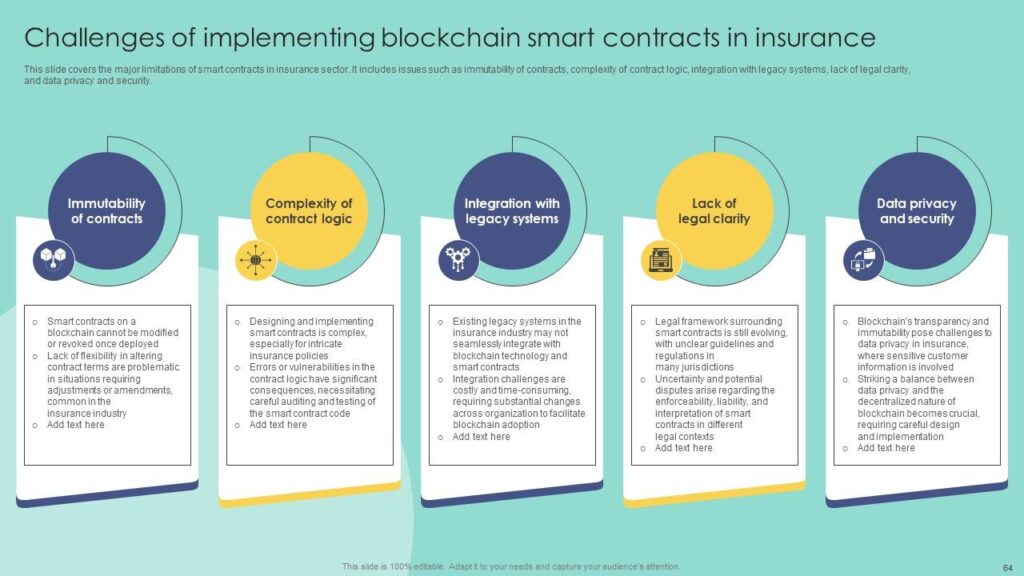

Despite the growing demand for crypto-insurance, the industry faces several legal challenges. A primary concern is the absence of standardized regulatory guidelines tailored specifically to cryptocurrency insurance products. Insurers and policymakers are actively working to establish clearer regulatory frameworks that address the unique characteristics of digital assets while safeguarding consumer interests.

Another significant challenge arises from the interpretation of policy terms and conditions in the context of crypto-related losses or disputes. The decentralized nature of blockchain transactions and the pseudonymous identities of cryptocurrency holders can complicate claims assessment and settlement processes. Insurers must develop transparent and equitable practices for resolving insurance claims effectively, ensuring fair treatment of policyholders in complex scenarios involving digital assets.

3. Contractual Considerations and Policy Terms

Insurance policies for cryptocurrencies are highly specialized and often incorporate unique terms and conditions tailored to mitigate specific risks associated with digital assets. Key contractual considerations include coverage limits, exclusions for certain types of losses (e.g., regulatory changes or market volatility), and requirements for policyholders to implement robust cybersecurity measures.

Insurers may include provisions related to the custody and storage of digital assets, such as mandates for using secure wallet solutions and multi-signature protocols. These measures aim to minimize the risk of theft or unauthorized access to cryptocurrency holdings, enhancing the security and reliability of insurance coverage in the face of evolving cyber threats.

4. Emerging Legal Trends and Developments

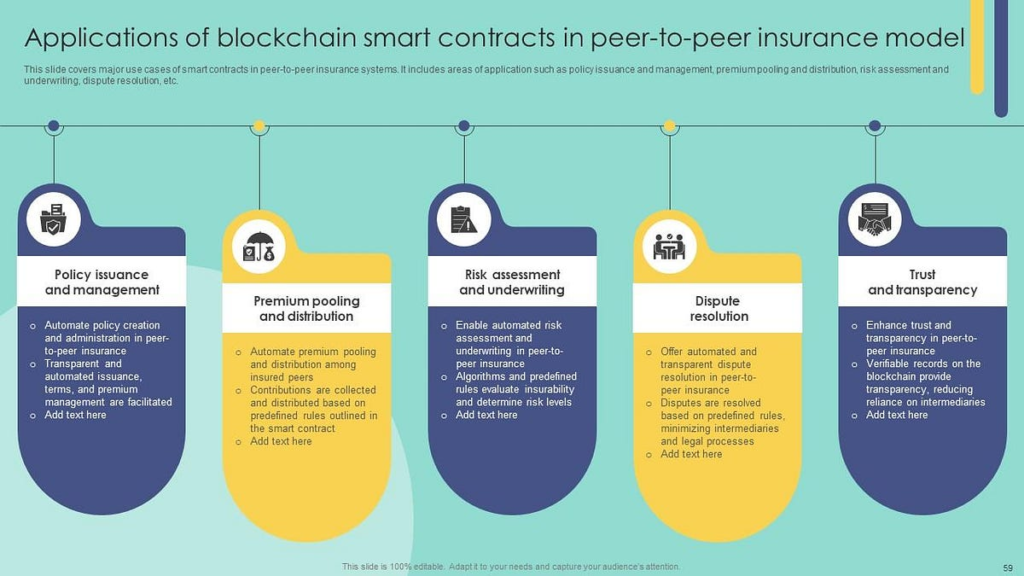

As the crypto insurance market matures, new legal trends and developments are shaping industry practices and regulatory oversight. One notable trend is the increasing collaboration between insurers, regulators, and blockchain technology providers to enhance transparency and security in insurance transactions involving digital assets.

Regulators are exploring the potential of blockchain-based solutions, such as smart contracts and decentralized insurance platforms, to streamline claims processing and improve regulatory compliance. These technological innovations hold promise for revolutionizing the insurance industry by offering more efficient, cost-effective, and secure solutions for insuring digital assets in a decentralized ecosystem.

5. Investor Protections and Consumer Rights

Consumer protection remains a critical priority in the crypto insurance market, where investors face significant financial risks due to market volatility and technological vulnerabilities. Insurers play a pivotal role in safeguarding investor interests by offering clear and comprehensive insurance products that provide adequate coverage and reliable claims handling.

Regulators are increasingly focused on enhancing investor protections through robust oversight and enforcement of consumer rights in the crypto insurance sector. Initiatives include educating investors about the risks and benefits of crypto insurance and ensuring fair treatment in claims resolution processes, thereby fostering trust and confidence in the integrity of insurance services for digital assets.

Conclusion

Navigating the legal landscape of cryptocurrency insurance requires a deep understanding of regulatory requirements, contractual obligations, and emerging trends. By staying informed about legal developments and compliance standards, insurers, investors, and regulators can collaborate to build a resilient and transparent crypto insurance market that promotes innovation while protecting stakeholders from financial risks associated with digital assets.

Thanks <3

Hello

တက်ပါတော့ comment ရယ်

လိမ္မာပါတယ် ဟယ်

နော် နော် နော်….လို့

Good night

Good night

Good night

Good night

6.7.24

Done😇😇

I want to be travel blogger but I don’t have the money to travel 🧳😔

Done at 1:10am.

Thanks 🥰